Since 10 July 2000, Airbus shares have been listed on:

- the Paris Stock Exchange

- the Frankfurt Stock Exchange

- and the Spanish stock exchanges in Madrid, Bilbao, Barcelona and Valencia

Type of shares: Bearer shares

Securities Code Number (ISIN Code): NL0000235190

In July 2000 EADS (stock exchange symbol EAD ) was created by merging Aerospatiale Matra of France, DASA of Germany (DaimlerChrysler Aerospace AG excluding MTU Triebwerke) and CASA of Spain (Construcciones Aeronauticas SA). Aerospatiale Matra was already listed on the Paris Stock Exchange prior to the merger. Its shares were then swapped on a one-to-one basis and new shares were issued.

In January 2014, EADS was renamed Airbus Group. As a result, its listing name (Airbus Group) and stock exchange symbol (AIR) were changed. However, its ISIN and Euronext codes remained unchanged. Airbus Group changed its stock market listing name to Airbus in January 2017. Its stock exchange symbol, ISIN and Euronext codes remain unchanged. On 12 April 2017 Airbus Group was renamed Airbus after approval of the respective resolution at the Annual General Meeting of Shareholders.

Airbus is included in the following major indices:

|

News and further company-related information can be found on:

Bloomberg

|

Reuters

|

Airbus shares are exclusively ordinary shares with a par value of € 1. The authorised share capital consists of 3,000,000,000 shares.

Issued shares and voting rights

The figures below show the total number of issued shares and treasury shares as respectively issued and held by Airbus, as well as the resulting aggregate amount of outstanding voting rights. This overview is updated within 5 business days after the end of each calendar month, the last update having taken place on 06 September 2021.

Status as at 31 August 2021

Total number of issued shares: Total number of treasury shares: Aggregate number of outstanding voting rights: |

786,020,816 235,435 785,785,381 |

| Number of shares | Issued as at 1st Jan. | Issued for ESOP | Issued for exercised options | Cancelled | Issued as at 31st Dec. |

| 2020 | 783,173,115 | 976,155 | 0 | 0 | 784,149,270 |

Previous years

| Number of shares | Issued as at 1st Jan. | Issued for ESOP | Issued for exercised options | Cancelled | Issued as at 31st Dec. |

| 2019 | 776,367,881 | 1,728,840 | 5,076,394 | 0 | 783,173,115 |

| 2018 | 774,556,062 | 1,811,819 | 0 | 0 | 776,367,881 |

| 2017 | 772,912,869 |

1,643,193 |

0 | 0 | 774,556,062 |

| 2016 | 785,344,784 |

1,474,716 |

224,500 |

14,131,131 |

772,912,869 |

| 2015 | 784,780,585 |

1,539,014 |

1,910,428 |

2,885,243 |

785,344,784 |

| 2014 | 783,157,635 |

0 |

1,871,419 |

(248,469) |

784,780,585 |

| 2013 | 827,367,945 |

2,113,245 |

6,873,677 |

53,197,232 |

783,157,635 |

| 2012 | 820,492,291 |

5,261,784 |

2,177,103 |

(553,233) |

827,367,945 |

| 2011 | 816,402,722 |

2,445,527 |

1,712,892 |

(78,850) |

820,482,291 |

| 2010 | 816,105,061 |

0 |

297,661 |

0 | 816,402,722 |

| 2009 | 814,769,112 |

1,358,936 |

0 | (22,987) |

816,105,061 |

| 2008 | 814,014,473 |

2,031,820 |

14,200 |

(1,291,381) |

814,769,112 |

| 2007 | 815,931,524 |

2,037,835 |

613,519 |

(4,568,405) |

814,014,473 |

| 2006 | 817,743,130 |

0 |

4,845,364 |

(6,656,970) |

815,931,524 |

| 2005 | 809,579,069 |

1,938,309 |

7,562,110 |

(1,336,358) |

817,743,130 |

| 2004 | 812,885,182 |

2,017,822 |

362,747 |

(5,686,682) |

809,579,069 |

| 2003 | 811,198,500 |

1,686,682 |

812,885,182 |

||

| 2002 | 809,175,561 |

2,022,939 |

811,198,500 |

||

| 2001 | 807,157,667 |

2,017,894 |

809,175,561 |

Current capital structure

Airbus had 786,020,816 shares issued as at 30 June 2021 (figures updated every quarter).

SOGEPA , GZBV and SEPI are holding companies for the French, German and Spanish governments respectively.

For the number of shares and voting rights held by members of the Board of Directors and Executive Committee, see the most recent Registration Document (Chapter 4 Corporate Governance) in our Annual Reports section.

Airbus dividend policy

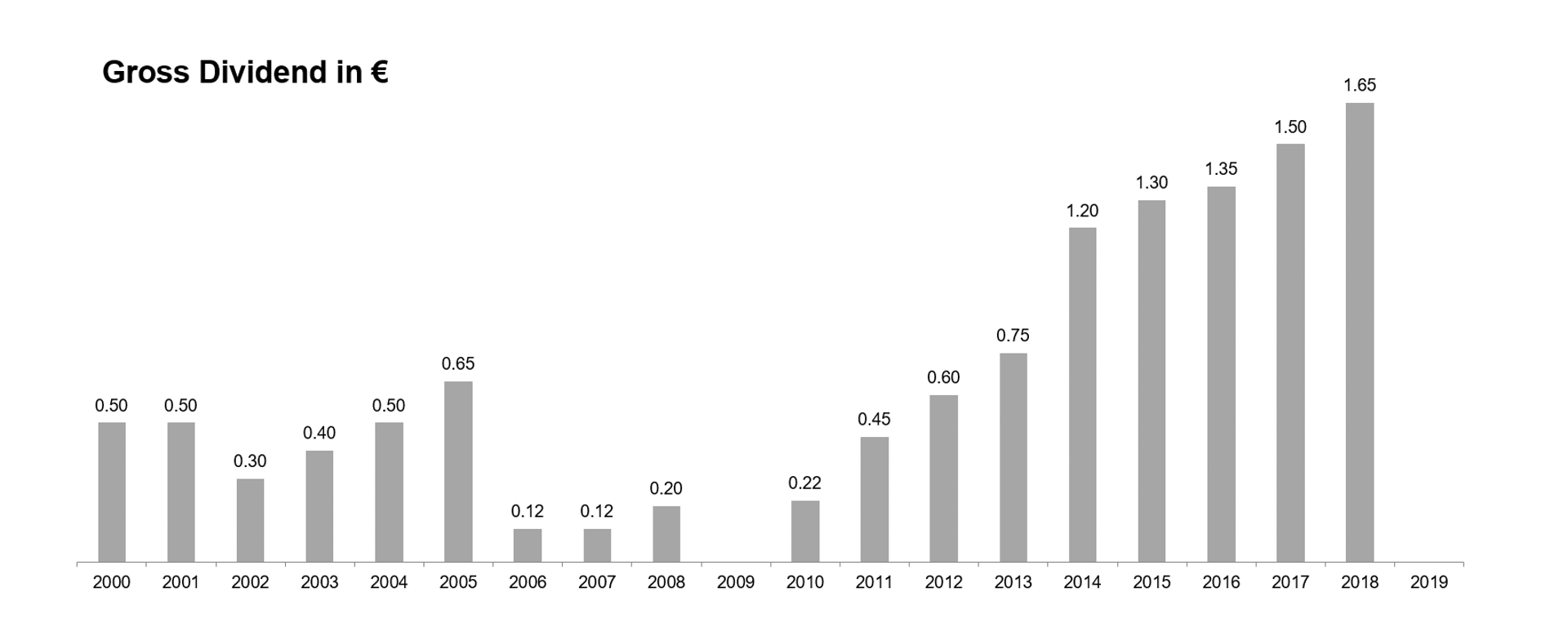

Since 2013, Airbus’ dividend policy has demonstrated a strong commitment to shareholders’ returns. This policy targets sustainable growth in the dividend within a payout ratio of 30%-40%.

Dividends and cash distributions paid since the incorporation of the company

Dividend taxation

As of January 1, 2007, based on Dutch tax law, all dividend distributions, independent of the origin/home country of the shareholder, are subject to a 15% dividend withholding tax. For more information please consult a professional tax advisor. See also the most recent Registration Document (Chapter 3 General Description of the company and its Share Capital) in our Annual Reports section.

Unclaimed dividends

Pursuant to Article 31 of the Articles of Association, the claim for payment of a dividend or other distribution approved by the Annual General Meeting of Shareholders shall lapse five years after the day on which such claim becomes due and payable. The claim for payment of interim dividends shall lapse five years after the day on which the claim for payment of the dividend against which the interim dividend could be distributed becomes due and payable.

Airbus implements from time to time share buyback programmes. In the framework of such programmes, Airbus fulfils trade reporting obligations to the stock exchange authorities in accordance with Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (“EU Market Abuse Regulation”).

Disclosure of transaction in own stock realised during the year

2020

Airbus SE reports the following share buyback transactions from 24 February 2020 to 27 February 2020 under Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (“EU Market Abuse Regulation”).

The transactions are part of a share buyback programme that started on 24 February 2020 for the sole purpose of covering Airbus’ long-term incentive plan in shares. The repurchased shares will be redistributed to the beneficiaries of long-term incentive plans according to the relevant plan rules. This share buyback programme was completed on 27 February 2020.

The share buyback is undertaken pursuant to the general authority conferred on the Airbus SE Board of Directors by the 13th resolution to repurchase up to 10% of Airbus SE’s issued share capital by the Annual General Meeting of shareholders of Airbus SE on 10 April 2019.

2019

Airbus SE reports the following share buyback transactions from 6 November 2019 to 12 December 2019 under Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (“EU Market Abuse Regulation”).

The transactions are part of a share buyback programme that started on 6 November 2019 for the sole purpose of covering Airbus’ long-term incentive plan in shares. The repurchased shares will be redistributed to the beneficiaries of long-term incentive plans according to the relevant plan rules. The share buyback programme was completed on 12 December 2019.

The share buyback was undertaken pursuant to the general authority conferred on the Airbus SE Board of Directors by the 13th resolution to repurchase up to 10% of Airbus SE’s issued share capital by the Annual General Meeting of shareholders of Airbus SE on 10 April 2019.

2018

Airbus started implementing a share buyback programme on 28 February 2018 for the sole purpose of covering its long-term incentive plan in shares. The repurchased shares will be redistributed to the beneficiaries of long-term incentive plans according to the relevant plan rules. The share buyback programme was completed on 10 April 2018.

The share buyback was undertaken pursuant to the general authority conferred on the Airbus SE Board of Directors by the 13th resolution to repurchase up to 10% of Airbus SE’s issued share capital by the Annual General Meeting of shareholders of Airbus SE on 12 April 2017.

2016

On 30 October 2015, Airbus Group SE announced a €1 billion share buyback for completion by 30 June 2016. Airbus Group SE appointed an Investment Services Provider (ISP) for the implementation of its share buyback as authorised by the Annual General Meeting of 27 May 2015. Under the terms of the agreement signed on 30 October 2015, the parties agreed that the ISP would sell a certain number of Airbus Group SE shares representing a maximum of €1 billion to Airbus Group SE, which undertook to buy them at market price between 2 November 2015 and 30 June 2016. The final price reflected the arithmetic average of daily Volume Weighted Average Price (VWAP) over the execution period less a guaranteed discount and did not exceed the maximum purchase price approved by the Annual General Meeting of 27 May 2015. All of the shares bought back under the agreement were cancelled.

For further information please refer to the Registration Document 2014, in particular Section 3.3.7.5 Description of the Share Repurchase Programme to be Authorised by the Annual General Meeting of Shareholders to be held on 27 May 2015, and Section 3.3.7.6 Description of the Exceptional Share Repurchase Programme to be Authorised by the Annual General Meeting of Shareholders to be held on 27 May 2015.

2014

For further information please refer to the Registration Document 2013, in particular Section 3.3.7.5 Description of the Share Repurchase Programme Authorised by the Extraordinary General Meeting of Shareholders held on 27 March 2013, and Section 3.3.7.6 Description of the Share Repurchase Programme to be Authorised by the Annual General Meeting of Shareholders to be held on 27 May 2014.

2013

| Institution | Analyst |

| AlphaValue | Romain Pierredon |

| Banco Sabadell |

Alvaro del Pozo |

| Barclays | Milene Kerner |

| Berenberg |

Andrew Gollan |

| Bernstein |

Douglas S. Harned |

| Citigroup Investment Research |

Charles Armitage |

| Commerzbank |

Norbert Kretlow |

| Credit Suisse |

Neil Glynn |

| Deutsche Bank | Christophe Menard |

| DZ Bank |

Alexander Hauenstein |

| Exane BNP Paribas (France) |

Tristan Sanson |

| Goldman Sachs |

Chris Hallam |

| JP Morgan |

David Perry |

| Kepler Cheuvreux |

Aymeric Poulain |

| LBBW |

Stefan Maichl |

| Melius Research |

Carter Copeland |

| Merrill Lynch (Bank of America) |

Benjamin Heelan |

| Metzler | Stephan Bauer |

| Morgan Stanley |

Andrew Humphrey |

| Oddo Securities |

Yan Derocles |

| Redburn |

Jeremy Bragg |

| SG Securities (London) Ltd. |

Zafar Khan |

| Stifel | Harry Breach |

| UBS Ltd. |

Céline Fornaro |

| Vertical Research Partners |

Robert Stallard |

For Airbus listing information on Euronext only: © 2019 Euronext N.V. All Rights Reserved. The information, data, analysis and Information contained herein (i) include the proprietary information of Euronext and its content providers, (ii) may not be copied or further disseminated, by any media whatsoever, except as specifically authorized, (iii) do not constitute investment advice, (iv) are provided solely for informational purposes and (v) are not warranted to be complete, accurate or timely.